Capital markets in developing countries—many still in their infancy—hold great potential to channel private capital toward priority development needs. Strong local capital markets are essential for a thriving private sector. They help people and businesses obtain long-term financing. They encourage the kind of entrepreneurial risk-taking that fosters innovation and accelerates job creation and economic growth. They can shield entire economies against potentially destabilizing fluctuations in international financial markets.

In developing countries, economic and social development is often limited by insufficient flow of private capital. In part, this is due to a heightened perception of risk in these countries, compounded by a lack of information or transparency or limited price discovery. Transparency and disclosure help companies in emerging economies access global capital markets and help global investors better price the risk of investing in these markets.

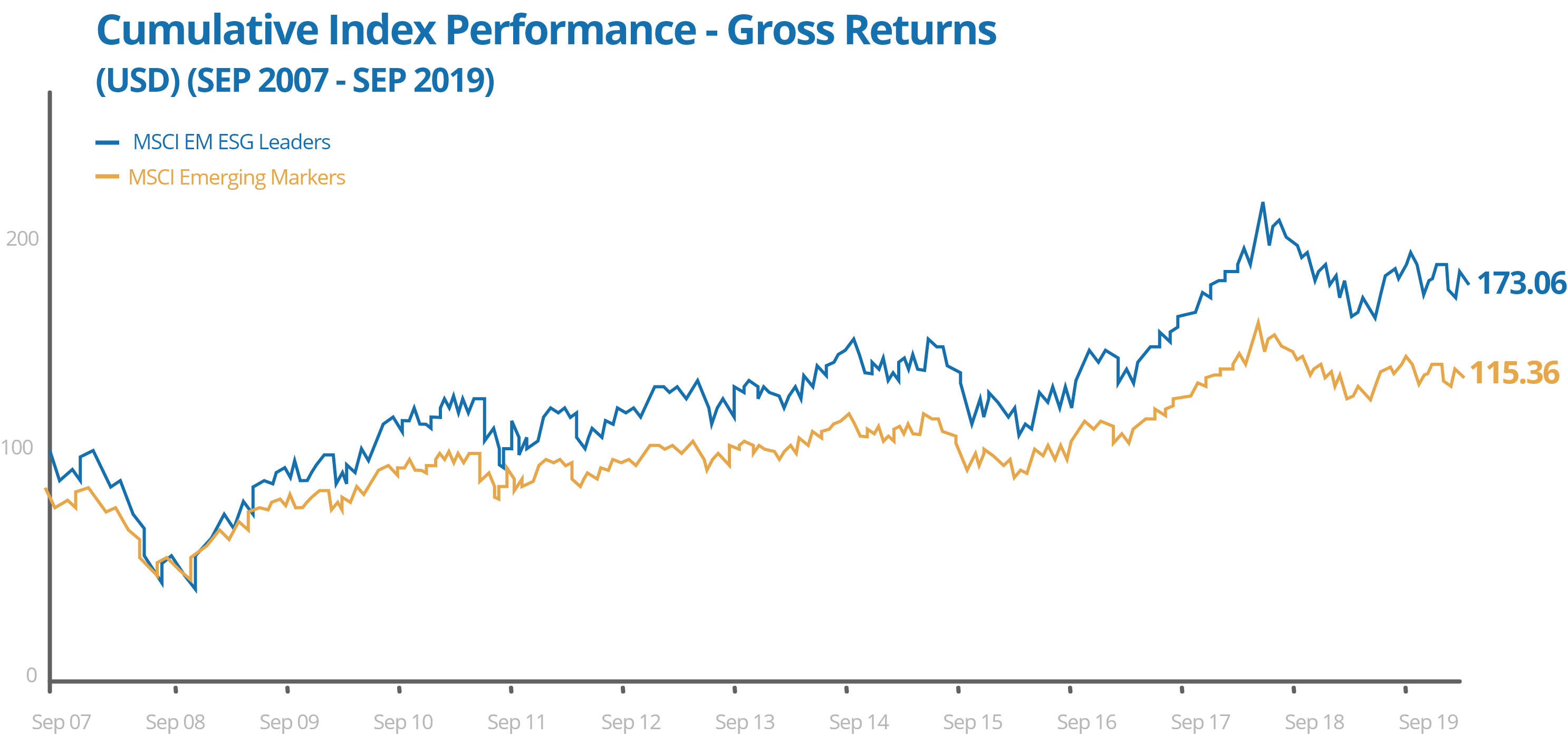

Stock exchanges that promote a higher level of ESG disclosure and transparency can create market mechanisms that promote sustainable finance, such as sustainability indexes that track the performance of equity or bonds of companies with higher ESG performance, or sustainable bond listing segments that list exclusively sustainable finance debt securities. These mechanisms make ESG investments more accessible, credible, and structured for investors, enabling them to benchmark the performance of their investment portfolio. They also provide a basis for passive investment funds such as exchange traded funds (ETFs).

IFC and its partner work with market regulators and stock exchanges in emerging markets a to develop customized regulatory and quasi-regulatory ecosystems that promote corporate governance and sustainability, and help attract foreign investments.

Corporate governance codes were originally developed as complementary to laws and regulations on corporate governance. Overtime, other tools have been introduced to create a more comprehensive regulatory ecosystem around ESG management and disclosure, including mandatory and voluntary schemes such as, laws, codes, standards, taxonomies, stock listing requirements and reporting guidelines.

Laws and regulations often provide the broad framework and principles for corporate governance and sustainability. Whether it is in commercial codes, securities laws or banking regulations, these instruments can provide the fundamental elements that are then developed in more details through other, more flexible mechanisms, including corporate governance codes, scorecards and sustainability reporting guidelines.

Corporate governance codes have emerged as a key element of the corporate governance reform movement. Codes are typically “soft law” – companies are not required to implement the rules but are required to disclose to the market when they do not (the so-called “comply-or-explain” approach). Comply-or-explain codes are more flexible than fully mandatory systems, allowing companies to opt-out of the code provisions, the comply-or-explain approach reduces the regulatory burden, and avoiding a “one-size-fits-all” approach.

Scorecards of best practices can help regulators assess observance of codes and standards of best practices. Scorecards can also help companies and banks analyze gaps and shortcomings of their corporate governance practices against national standard. Investors can use scorecards to guide their analysis of corporate governance practices in the companies they invest in.

ESG reporting guidelines help countries raise their overall standards of corporate disclosure and transparency and attract investments through credible, comparable decision-useful information. ESG reporting complements financial reporting with critical information on stakeholders, sustainability matters and corporate governance that can impact the company and the communities and society around it.

Sustainable finance frameworks can help countries ensure the consistency, completeness and coherence of various piece of their regulatory and quasi-regulatory arsenal to ultimately promote corporate sustainability and sustainable finance. Taxonomies are often at the center of Sustainable finance framework, providing a common definition of sustainable activities for various related market activities, sourcing sustainable finance, annual reporting, and on-going investor relations

Separate listing segments or financial indexes focused on sustainability can play a major role in driving corporate progress and they are typically linked to existing regulations or standards for corporate governance and sustainability reporting.

This database highlights IFC’s works with regulators, stock exchanges and capital market stakeholders around the world on developing, implementing, and assessing laws and regulations, codes or corporate governance, scorecards of best practices and ESG Reporting Guidelines.

This platform provides useful tools, resources and examples for regulators and stock exchanges to develop a complete and coherent regulatory framework around corporate governance and sustainability, and to promote a strong culture of transparency and disclosure.

Whilst globalization of economies has increased, and international corporate guidelines have been adopted, each country has its own values, societal norms, way of doing business, and special circumstances. Thus, to guide policy makers, market players, and corporations in adopting sound corporate governance practices at the local level, every country should endeavor to develop its own corporate governance code. The toolkit sets out a step-by-step approach that could be followed by stakeholders to develop, implement, and review a Corporate Governance Code of Best Practice.

This publication focuses on how to use scorecards to measure the observance and implementation of corporate governance codes. It provides practical guidance and a step-by step approach on how to develop a corporate governance scorecard, presents different approaches to scorings based on the experience of different scorecard users in different countries, and shows how scorecards are adapted to local circumstances and the local corporate governance framework.

The toolkit supports the broader World Bank Group’s effort to enhance disclosure and transparency standards in developing countries. It provides guidance on preparing comprehensive and integrated annual reports that include critical environmental, social, and governance information to companies, stock exchanges, market regulators and investors alike.

Stock exchanges can also encourage listed companies to use our communications and report creation tools to raise disclosure standards in their markets while lowering the reporting burden.

Link to comprehensive databases of securities regulator instruments and ESG disclosure guidance maintained by our partner the Sustainable Stock Exchanges Initiative (SSE). This includes corporate governance codes, reporting requirements, green and sustainable bond standards, investor stewardship codes and regulation

Our Online Learning can be used by stock exchanges to build their capacity to train company executives and boards on disclosure and transparency

IFC partners with the Sustainable Stock Exchanges initiative in expanding the scope of its work to a group of more than 103 stock exchanges committed to sustainability throughout developing and developed markets.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.