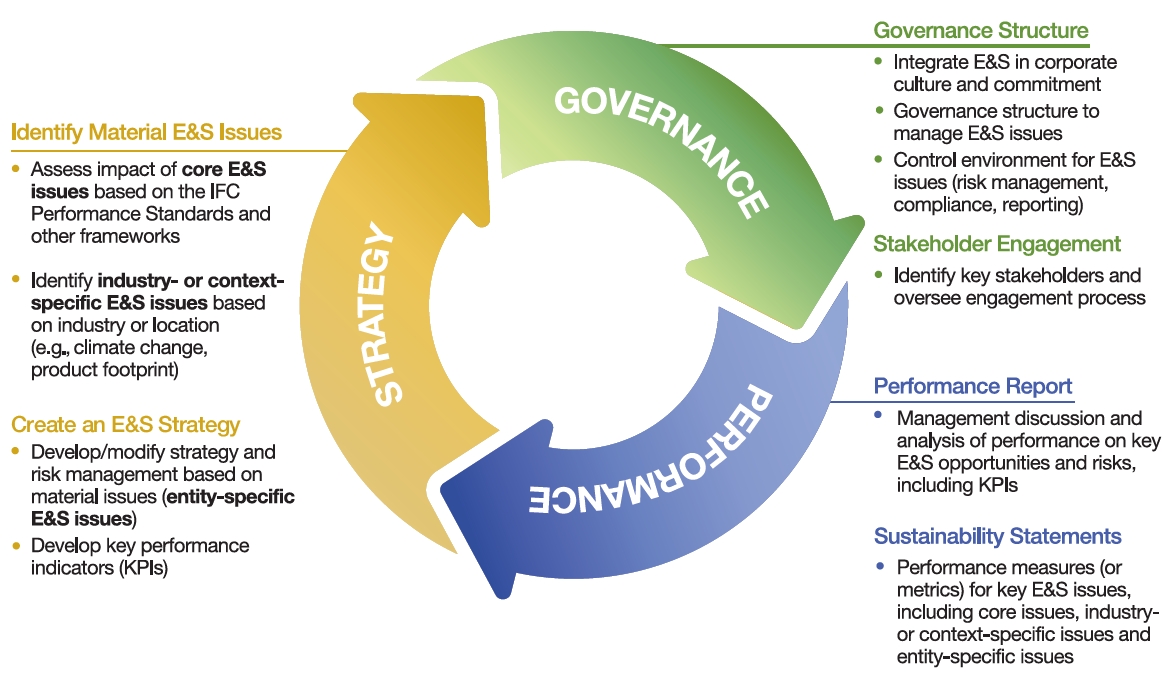

The toolkit goes beyond traditional financial reporting to address the pillars of modern corporate value creation – strategy, governance and performance while integrating material sustainability factors.

Since its launch in January 2018 at the London Stock Exchange, the toolkit has been used extensively throughout emerging markets, including in IFC’s advisory work with companies, banks, stock exchanges and regulators in many countries in Africa, Asia, Middle East and North Africa, Europe and Central Asia and Latin America. IFC also uses it to support its investment activities in emerging market companies.

Across emerging markets, the toolkit is used to promote higher standards of disclosure and transparency – working with companies, banks, stock exchanges and regulators. The goal is to

of investing in emerging and frontier markets and to drive investments in sustainable development.

The Toolkit Toolkit supports IFC’s 3.0 Strategy, which aims to create markets in emerging economies and unlock the trillions in annual investment needed to realize the World Bank's twin goals of ending extreme poverty and promoting shared prosperity—and achieve the United Nations Sustainable Development Goals.

The Toolkit draws on IFC's emerging markets investment experience and integrates its Environmental and Social Sustainability Performance Standards and Corporate Governance Methodology.

It brings together and streamlines all major international reporting standards including GRI, IIRC, SASB, TFCD, OECD, and IFRS) and best practices from leading companies.

The Toolkit is designed to help companies prepare disclosures that are commensurate with their size and organizational complexity and adapted to their context of operation.

It can be used in modules to implement different depths of reporting in each pillar – strategy, governance and performance – and help companies gradually improve their disclosure practices. Progressive levels are based on IFC’s corporate governance progression matrix.

The toolkit was first introduced in print and translated in 4 different languages. It is now offered as an online interactive tool that as part of the broader IFC Online Platform Beyond The Balance Sheet.

A print version is available here, with translations in: