ESG Disclosure

ESG or sustainability disclosure is often referred to as ‘non-financial reporting’. Yet, sustainability activities and approaches can have major impacts on the financial results of companies, and by extension its investors. Investors have observed the rising impact of ESG on company activities and financial returns and they are increasingly demanding quality ESG disclosures.

ESG Disclosure Standards

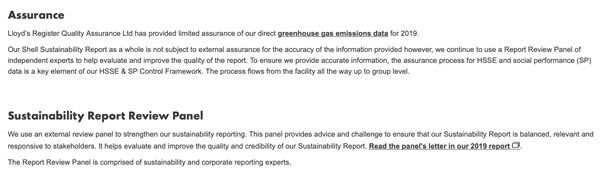

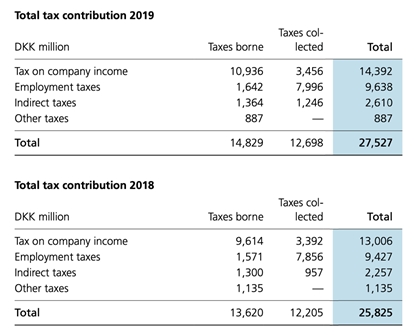

There are multiple standards and reporting requirements in ESG reporting (see Table below on Major Disclosure Frameworks and Standards). At present, companies must choose between such standards and frameworks. Reporting methodologies and approaches are complex and dynamic, requiring deep professional knowledge and expertise and must be backed up with sustainability strategies and risk management processes.

Major Disclosure Frameworks and Standards

ESG Disclosure Process

Steps recommended for sustainability information:

- Identification of internal responsibility for ESG reporting

- Stakeholder mapping exercise

- Targets or indicators for each information need

- Include material content for the company and its stakeholders

- Review and approval by the board

The diagram below presents a 5-step process for the preparation of the report