Qualifications and Independence

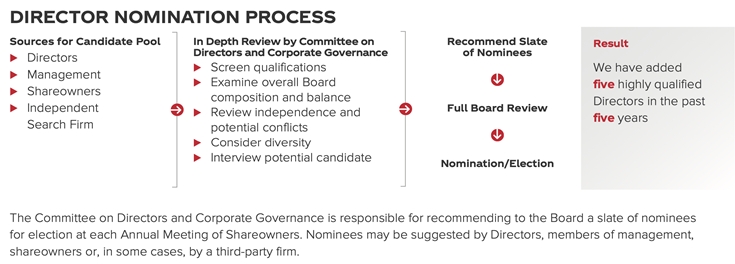

Nomination and appointment

The report should describe the process of nominating and appointing directors. It should also summarize the roles of the board, the nomination committee (if any), and shareholders in nominating and appointing board members. The report should indicate the term of each Board member and whether they have reappointed for multiple terms. Where companies have board members representing employees, creditors, or government, the report should describe how they are appointed.

Qualification

The report should present the relevant age, gender, background, work experience, education, and other board positions currently held by each board member. It should emphasize board members’ qualifications that are relevant in their board roles, including committees they serve on. It should also link to the wider strategy and purpose of the company.

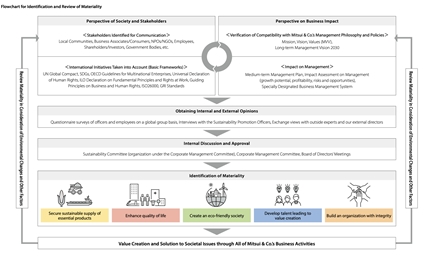

Sustainability

The report should describe the board’s expertise on sustainability matters and whether board members receive training on ESG issues generally and for the industry sector.

Best Practice

The concept of the “strategic-asset board”) suggests that companies have in place a longer-term board succession plan that ensures that the composition and qualifications of the board are aligned with the company’s strategy and the required qualifications of directors.

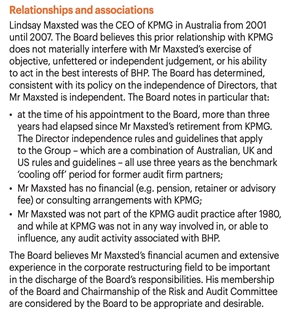

Independence

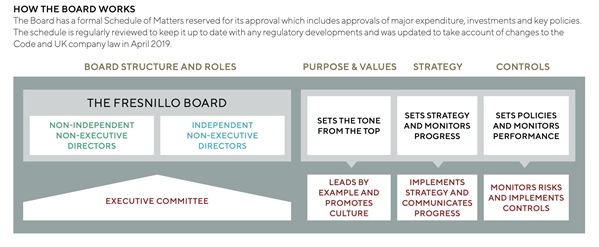

The report should define the different types of directors and levels of independence:

- Executive board members: board members who have fulltime (usually C-level) positions;

- Non-independent non-executive board members: board members who do not work fulltime for the company but have some other significant link to it;

- Independent non-executive board members: Sometimes more justification may be necessary in situations where independence seems compromised

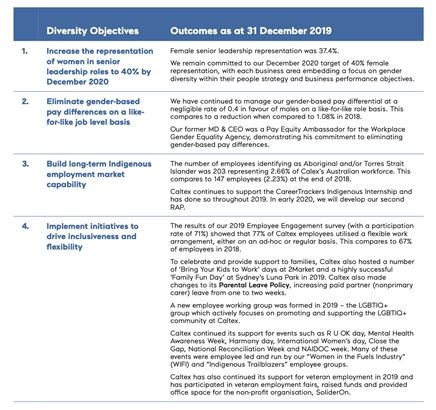

Diversity

Boards are increasingly expected to achieve better gender balance and draw from a wider pool of potential candidates. Beyond gender, this can include candidates of different ages, ethnicities, and other differences in background, including relevant experience or expertise. The report should explain how diversity was considered in recent board nominations and any policy of the board in this area.