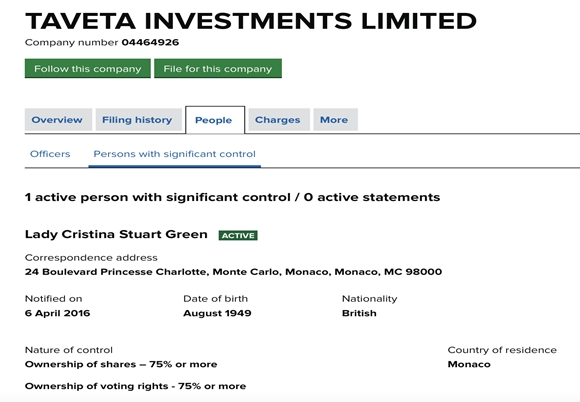

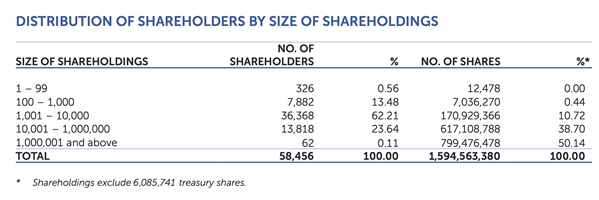

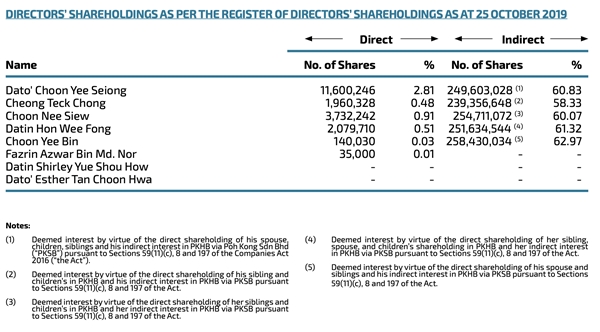

Ownership and Control

The report should give a clear view of who owns the company, including those who own or can exert influence, directly or indirectly.

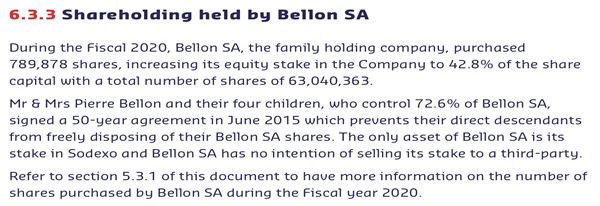

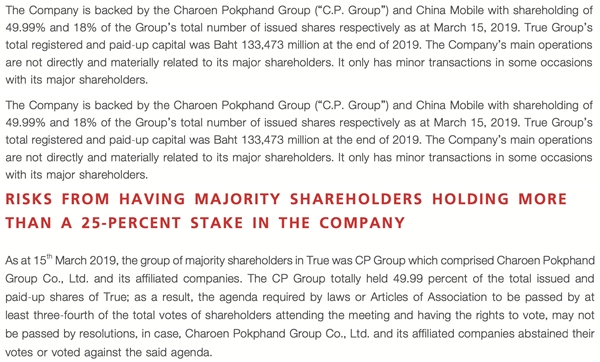

Indirect or “Deemed” Ownership

Disclosure on ownership and control should also include arrangements that provide indirect control or deemed ownership. including:

- Shareholder agreements to vote shares in line with those of a substantial shareholder;

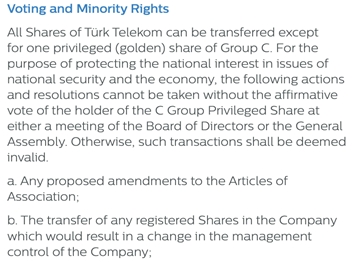

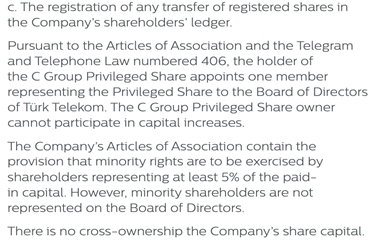

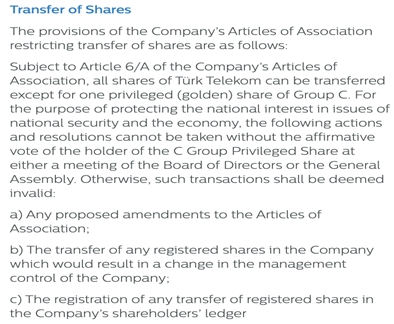

- Special voting rights;

- Multi-voting shares and the voting rights they grant to major shareholders;

- Control-enhancing or anti-takeover mechanisms, such as voting caps and poison pills;

- Special shareholder rights (golden share) to block certain major decisions or to appoint one or more board members directly (common in state-owned enterprises).

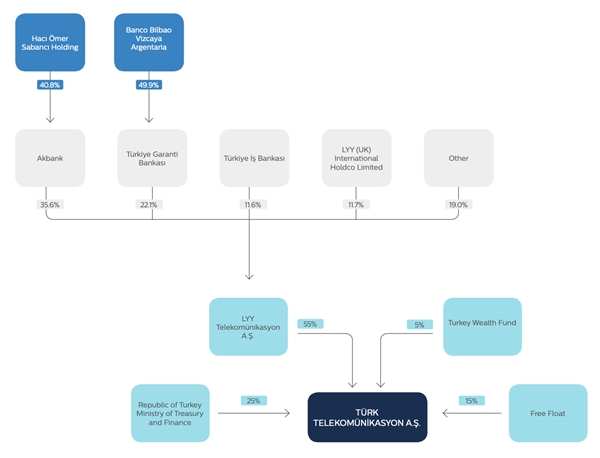

Groups and Control Chains

The report should indicate whether the company is part of a group and, if so, how it fits in. It should also disclose the various intermediaries, if any, through which a controlling shareholder holds control.