Best Practice

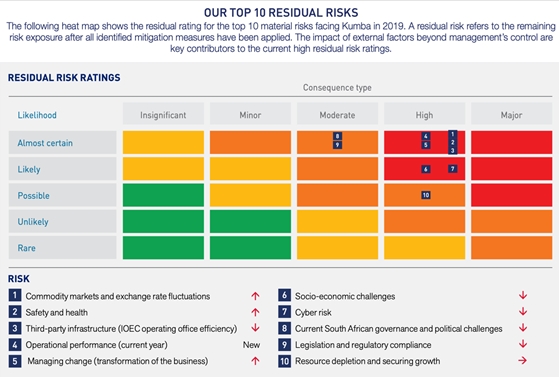

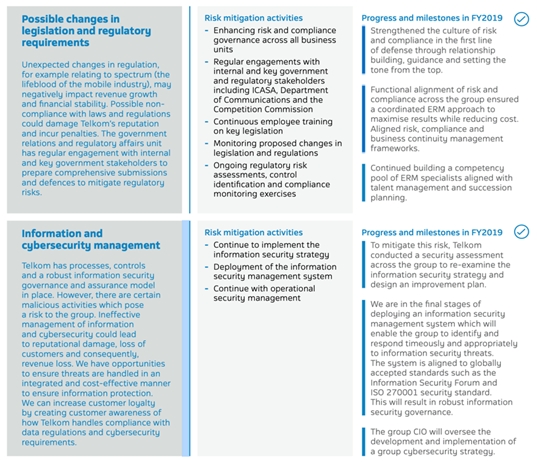

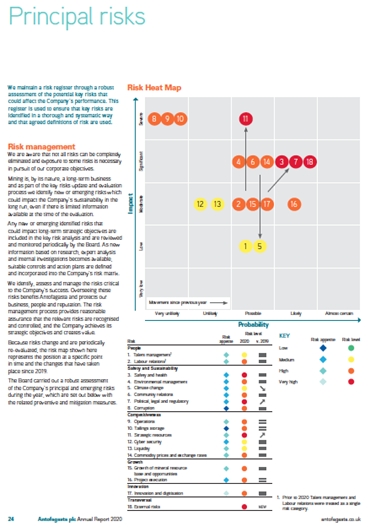

Companies should report on emerging as well as ongoing risks. They should also disclose how the likelihood of risk occurrence is changing over time. Risks are constantly evolving, just as the company’s strategy and external environment evolve.

Sustainability issues can constitute major risks for companies and therefore they be an integral aspect of risk analysis, monitoring, and management.