Materiality Assessment

Concepts of Materiality

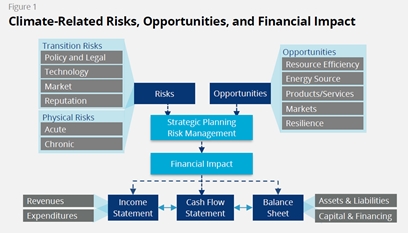

With the evolution of corporate reporting towards integrated reporting and the consideration of sustainability in the core strategy of companies, new concepts of materiality have emerged to guide companies

The concept of materiality was originally introduced for corporate financial reporting -- to ensure disclosure information that a reasonable investor would consider important in making an informed decision (IFRS, FASB). With the advent of sustainability reporting, the concept was also used to gauge the disclosure of significant economic, environmental, and social impacts of companies or matters that substantively influence the assessments and decisions of stakeholders, beyond investors(GRI).

Building on these two related concepts, the IIRC introduced an integrated approach based on long-term value creation. It defined as material the “matters that substantively affect the organization’s ability to create value over the short, medium, and long term,” where value creation is defined with reference not only to financial capital but also to manufactured, intellectual, human, social and relationship, and natural capitals.

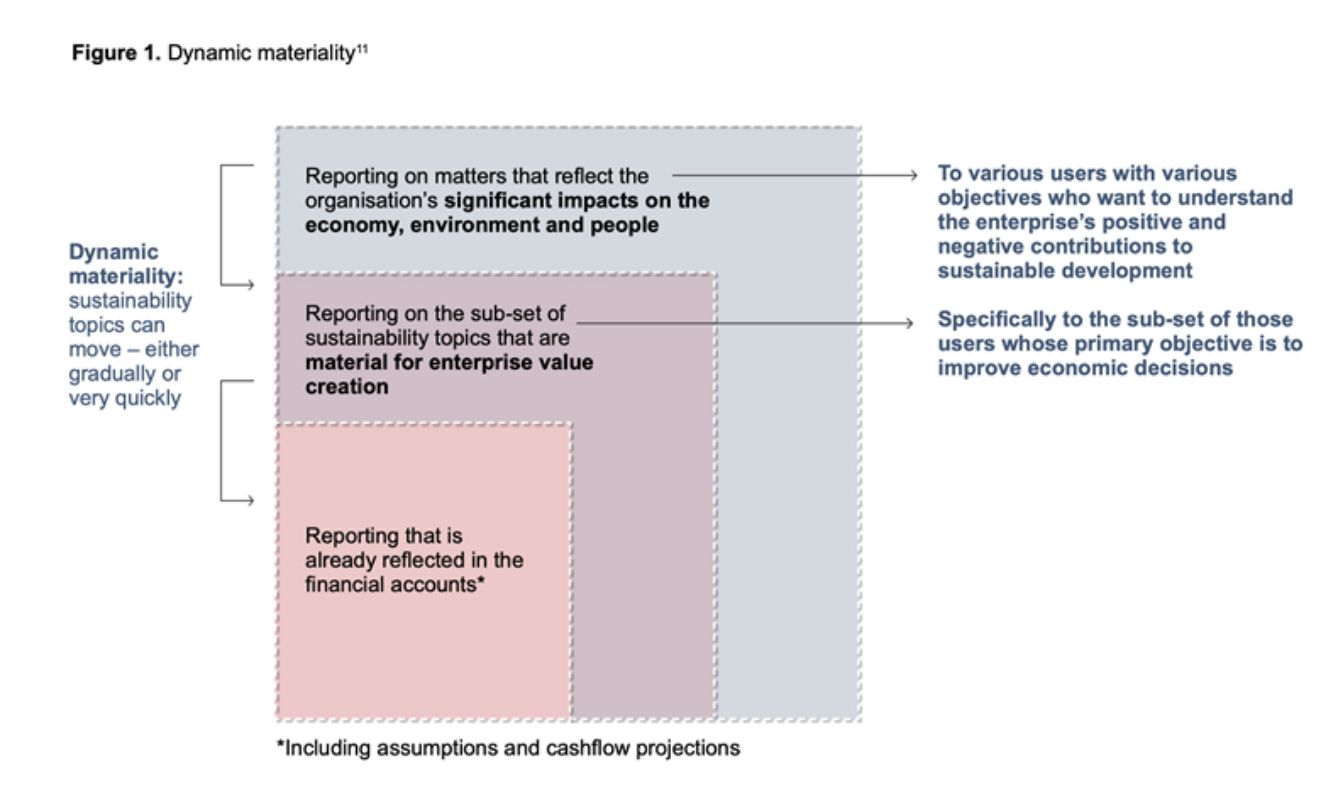

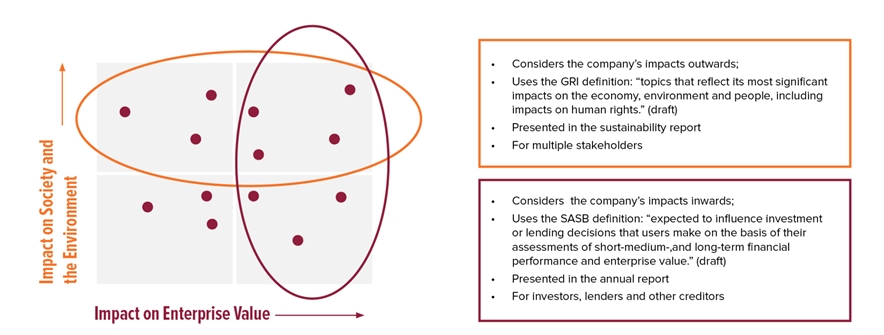

Recently, the concepts of double materiality and dynamic materiality have been introduced to capture these various perspectives on what is material to – and therefore should be disclosed by – companies.

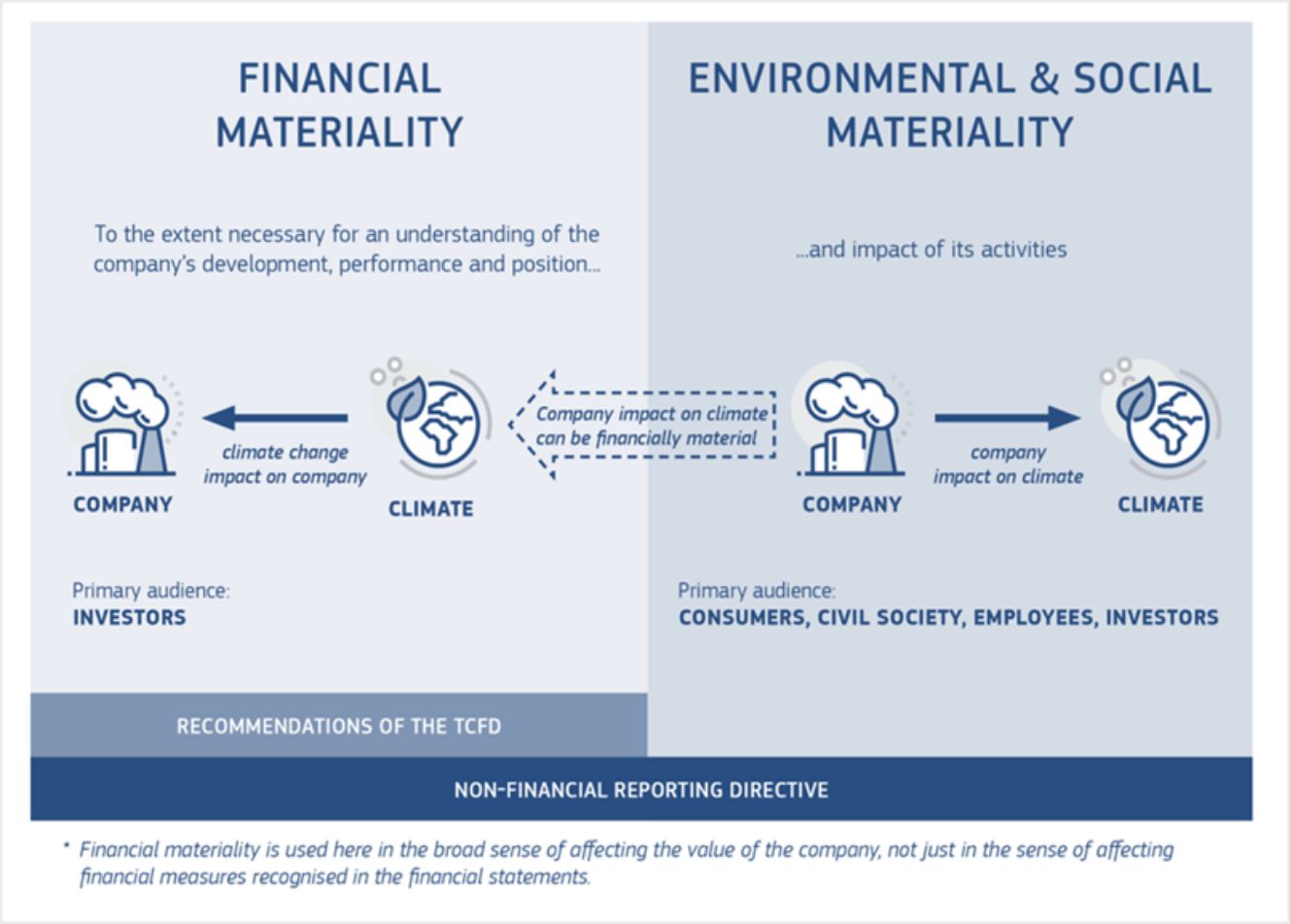

double Materiality

Financial materiality, referring to the company’s “development, performance [and] position

- Financial materiality, referring to the company’s “development, performance [and] position

- Environmental and social materiality referring to the “impact of the company’s activities

dynamic Materiality

In 2020, CDP, CDSB, GRI, IIRC and SASB came together on a shared vision for corporate reporting that serve distinct but related materiality concepts for sustainability disclosure. The group introduced the concept of “dynamic materiality” (see below) to reflect the changing nature of sustainability issues, the range of users of that information and the impact on company performance.

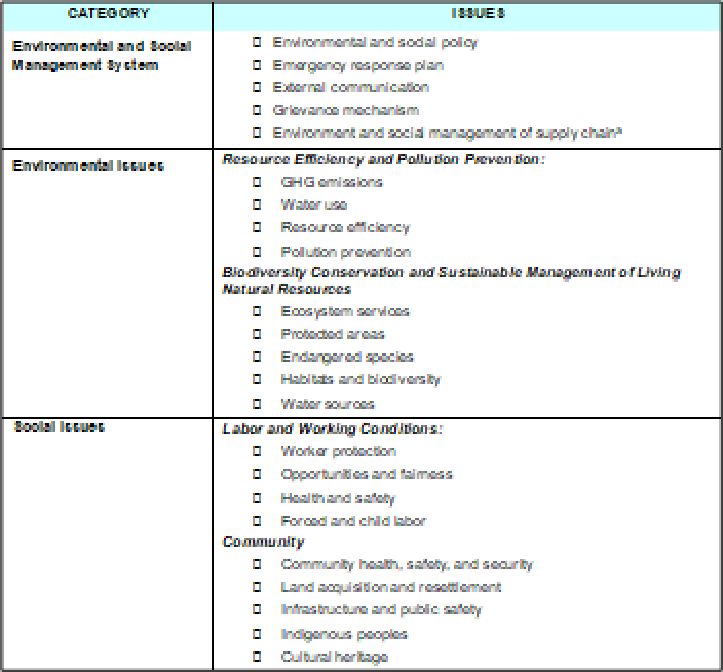

Methods for Assessing Materiality

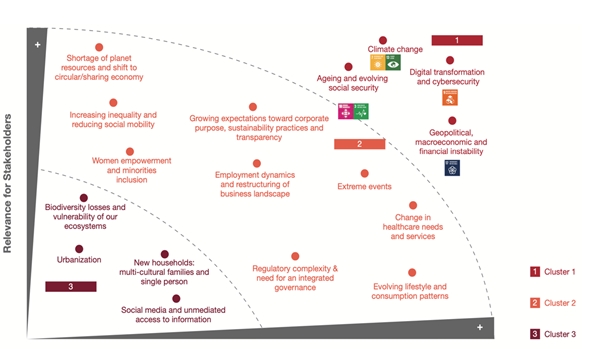

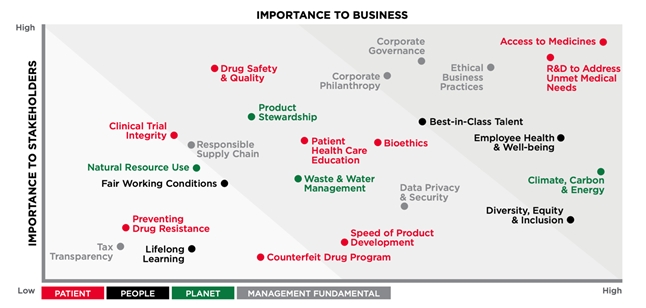

A common method for disclosing prioritization of material issues is to create a materiality matrix that ranks the importance of sustainability issues to the company against the perception of its key stakeholders.

Compliance—Aggreko plc, 2019 Annual Report

This example shows the materiality matrix for an Italian insurance company, with ageing and financial stability as two issues that are critical for the company and its stakeholders.

Materiality Matrix—Takeda 2020 Sustainability Report

This example shows the materiality matrix for a Japanese pharmaceutical company, with access to medicine and R&D for unmet medical needs as the two main issues the company and its stakeholders.

Materiality Matrix—2019 CEMEX Integrated Report

This example shows the materiality matrix for a Mexican cement company, with health and safety and product quality as two issues that are critical for the company and its stakeholders.

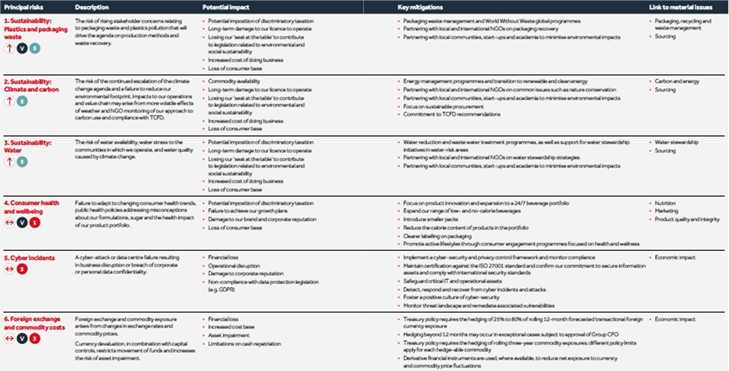

Principal Risks and Material Issues—Coca-Cola HBC

In this example, bottling company Coca-Cola HBC, makes the link between principal risks and material issues.

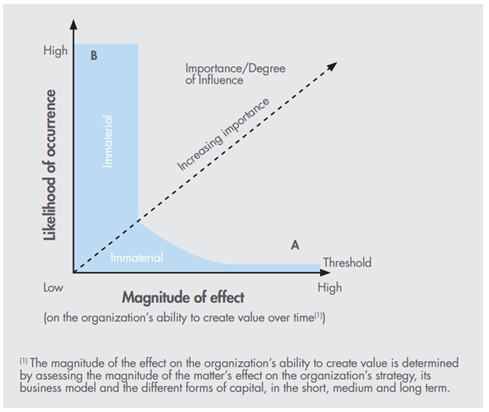

Another method is to assess the combination of probability and magnitude of impact of sustainability issues, in order to determine if they reach the materiality threshold. Issues that have a greater likelihood of occurring or a greater likelihood of significant impact on either the reporting organization or its stakeholders should be determined to be of greater importance.